L'Oréal ($OR.PAR): an ESG lens on the 'roaring twenties' recovery stock

Is it really decoupling growth and impact?

We’ve all heard about the ‘roaring twenties’ thesis: that the success of the various MRNA vaccines means the combination of loose fiscal policies around the world and pent-up consumer demand is going to create a historic decade of spending and indulgence. Investors in airlines, luxury goods, property and consumer durables are all set to benefit.

What’s more, this uplift is layered on top of a number of emerging supercycles and megatrends in technology - from computer games to transport to agriculture - which are opening up previously unheard of investment opportunities for investors of all sizes.

On a recent Motley Fool Answers podcast episode on the Net Zero economy , Paris-based global beauty giant L’Oréal was mentioned as one option to research for investors seeking to build positions in companies on the path to net zero (listen from 27m15s if you want to skip through the preamble and other ideas)

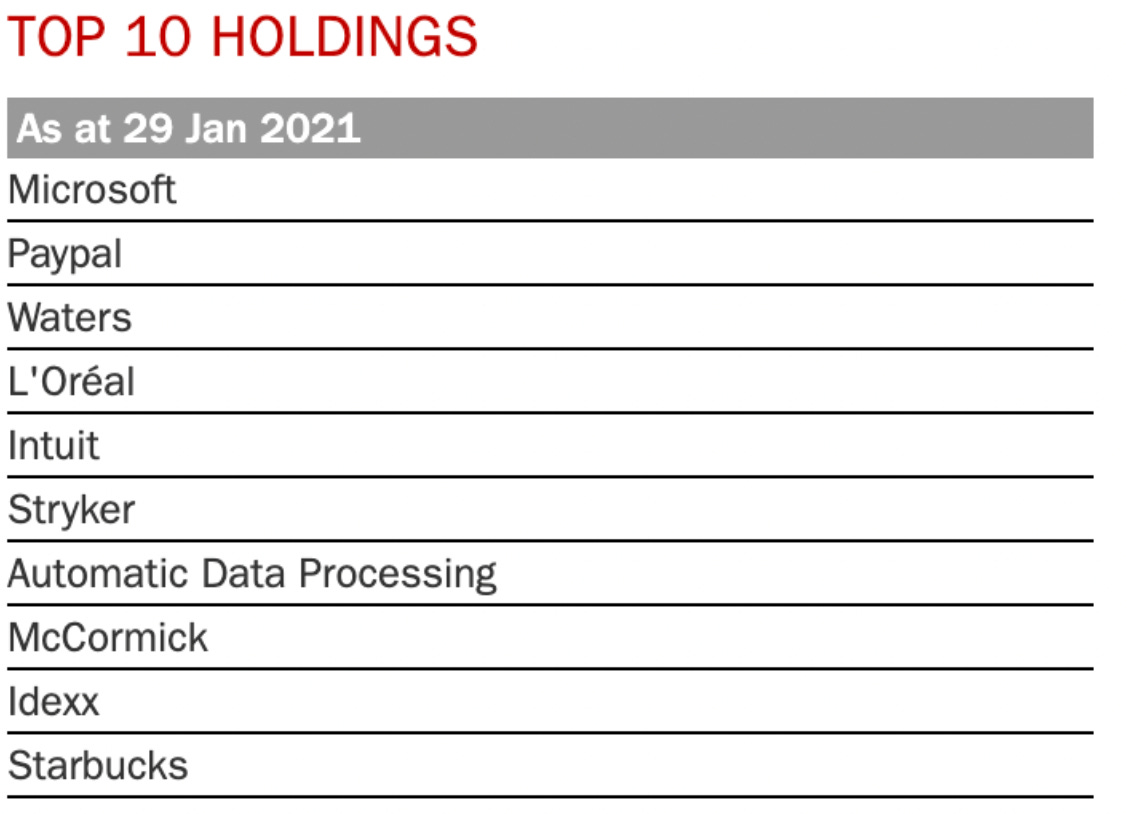

And knowing that one of the most widely respected sustainable funds here in the UK - Fundsmith - has the owner of Lancôme, RedKen and others in its top ten largest positions (see below) I decided to take a closer look.

By the way: Fundsmith not only have excellent record at outperforming the market, their sustainability credentials appear to exclude a significant amount of sin stocks, and positions to which that descriptor may not normally be applied. You can download the fund factsheet here:

COMPANY PROFILE

L'Oréal SA engages in the manufacture and sale of beauty and hair products. It operates through the following segments: Professional Products, Consumer Products, L'Oréal Luxury, and Active Cosmetics. The Professional Products segment manufactures products which are used and sold in hair salons. The Consumer Products segment offers beauty and care products for men and women which are sold in mass market retail channels. The L'Oréal Luxury segment markets high-end skin care and beauty products in selective retail outlets such as department stores, perfumeries, and travel retail. The Active Cosmetics segment offers dermocosmetic skincare products which are sold in pharmacies and specialist sections of drugstores. The company was founded by Eugène Schueller in 1909 and is headquartered in Paris, France.

The company owns 36 globally recognised brands including Maybelline, RedKen, Garnier, Lancome and YSL Beauté.

Ownership: 23% Nestle, 33% Bettencourt family

Market Cap: 173B

PE ratio TTM: 48.71

2020 Rev: €28B, -7% YOY

Net income €3.5B, -6.5% YOY

Free Cash Flow ~€5.5B, +8% YOY

Earnings Per Share: €7.3

Divided 1.3%

Credit: Refinitiv/FT

ESG PROFILE

L'Oréal make some impressive claims about their previous efforts, including that between 2005 and 2019, they achieved a 78% reduction in carbon emissions at their manufacturing facilities around the world - and this during a period in which output increased 37%

L'oreal make several impressive claims:

Between 2005-19, a 78% reduction in carbon emissions in manufacturing faciltiies, while increasing output 37% 'decoupling impact from growth'

19 carbon neutral sites in 2019, 40 in 2020

L'Oréal for the Future is the name given to the campaign announced in summer 2020 which it claims will ramp up delivery against its targets in the coming decade. You can watch the presentation the company gave last year here:

Key takeaways include:

Achieving carbon neutrality through energy efficiency and use of 100% renewable energy at all L’Oréal sites by 2025.

Moving to recycled or bio-based sources for 100% of the plastics used in L’Oréal’s products’ packaging by 2030.

Reducing greenhouse gas emissions by 50% per finished product by 2030.

Allocating €150 million to address urgent social and environmental issues

Reduced weight of packaging, and increase the use of biodegradable materials - 95% of products 'improved env profile'

50% reduction in carbon emissions for each finished product unit

100% of all sites will be carbon neutral by 2025

Redesigning products to incorporate plant-based and organic materials

Biochemistry utilised to help products require less water use to rinse off - aim to help reduce emissions by 25% by reducing water needed to clean off products

Water use - 100% of water used at sites in production will be closed loop by 2025. So called ‘dry factories’ are examined here by BlueTech Forum

95% of ingredients from abundant sources or env friendly procedures such as biochemistry

100% of packaging post consuner use recuycle or biosourced plastic

Reduce use of virgin plastic by -50% in 2025

100% of strategic suppliers and employees to be paid at living wage

Continue to help ppl from underpriviliged communities to access employment

€50M will dedicated to eliminating linear materials from supply chain and driving closed-loop agenda

€50M to regeneration of degraded biodiversity invested in projects forest and coastal lands to give 100M hectares of restored

New labelling which explains the environmental and social credentials of each product.

Evaluating L’Orêal’s ESG credentials and RISK RATING

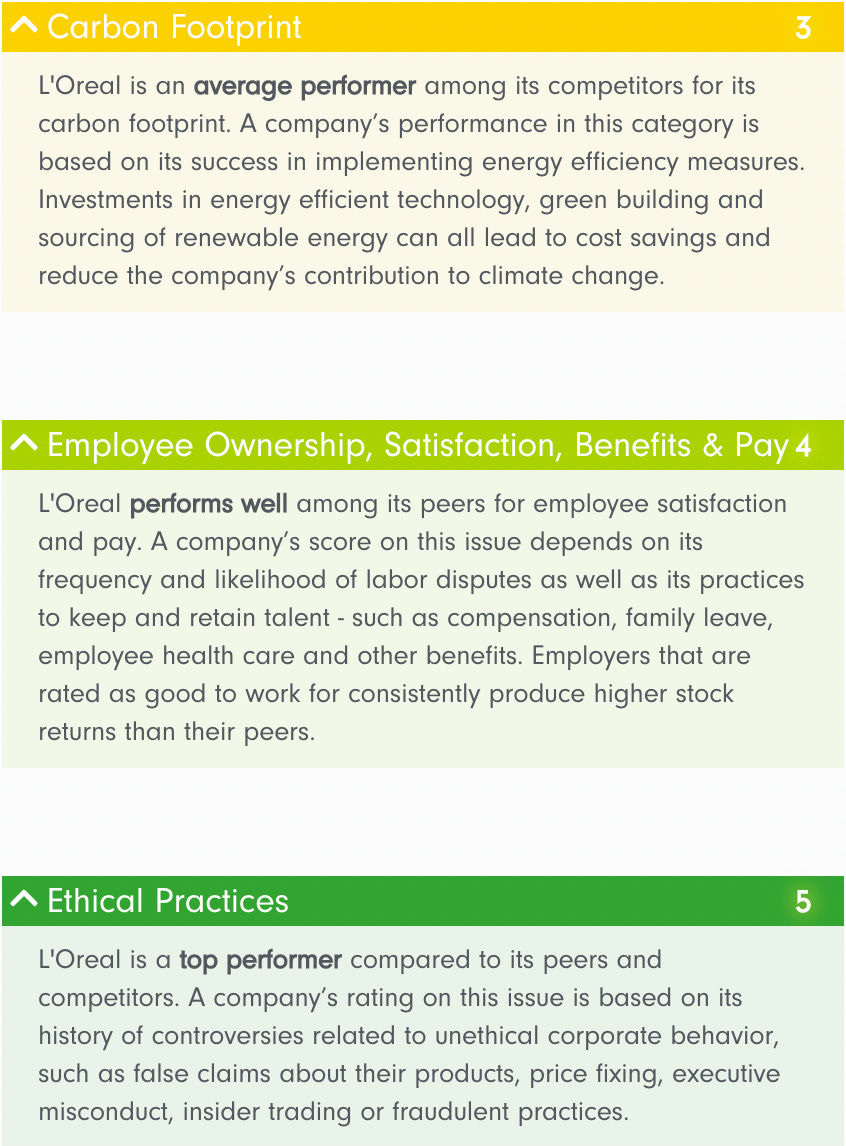

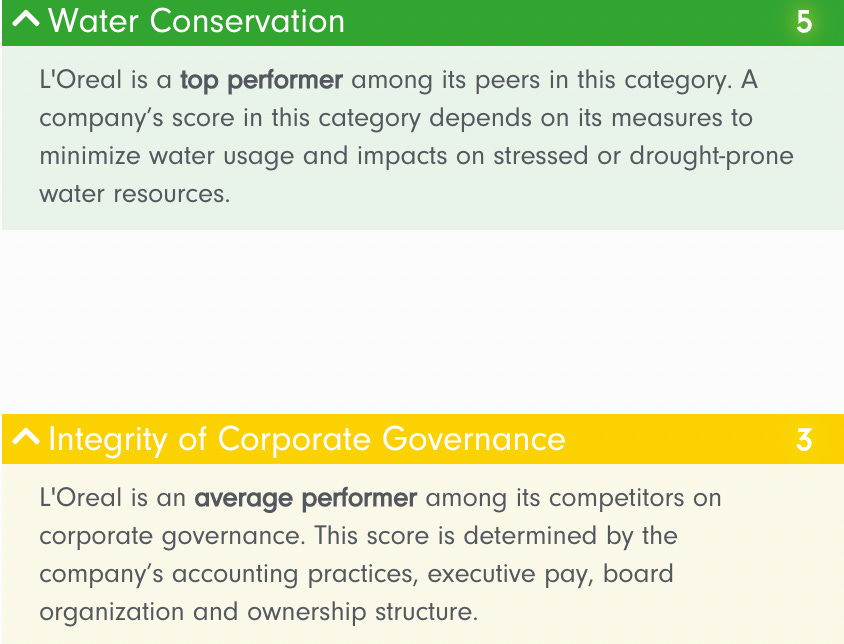

This all sounds pretty exciting. But lets set the company’s own claims to one side for a second and see what the growing ESG audit agencies think about whats being proposed. Censible’s Mindful Investing Insights ranks them as average to good on most metrics when compared to their peers:

It looks to me like its an above average performer AS THINGS stand, with an agenda which is progressive compared to some of its peers. It’s also quite a way down that line, having been exploring how it can improve its impact since at least 2005.

Another rating agency, Sustainalytics, which provide ratings to Yahoo Finance, gives them a medium ESG risk rating:

Given the ambition of measures to reduce their operating footprint, this is likely due to three factors. The continued reliance on palm oil, animal cruelty, and the Nestle connection:

Palm oil

Palm oil is widely used in beauty goods because of its moisturising, foaming and texturising properties. Indeed its palm oil's versatility has led to a spiralling proliferation of use-applications over recent decades. Its in a staggering array of materials, from pizzas dough to biofuels - and, of course, makeup & shampoos etc

The WWF place L'Oreal joint 3rd ahead of IKEA, Co-Operative Group and others more commonly associated with ethical production

https://palmoilscorecard.panda.org/check-the-scores/manufacturers/loreal

For more information on the way that companies should think about change see, have a look at this great infographic

Animal Cruelty

In order to export skin & haircare & beauty products to China, the govt there will require producers to pay for animal testing by a govt agency. Changes have been introduced since Jan 2021, so theoeretically fewer animals are at risk. But all imports are still liable to this eventuality. www.ethicalelephant.com has a great explainer

Many companies have had to compromise on principles to trade in China, but as Chloe Bullock - vegan interiors specialist (who i reached out to for advice) - pointed out, L’Oréal has been shunned by many ethical consumers and advocates.

If you’d like to find out more about how to include cruelty-free products in your home or workplace, reach out to Chloe at @materialiseint on Instagram

The Nestle Connection

Nestle has been a controversial company for a long time now. Deriving profit and increasing pollution by buying public spring water and selling it with as much 5000% return and making billions in the process. They've been the subject of an episode of Netflix' Rotten:

They've been subject to legal action multiple times for child slavery in their supply chain (not alone in the confectionary world on that front):

It should be noted that Nestlé claim to have developed a robust ESG:

IS IT INVESTABLE?

L’Oréal seems set to have a great decade ahead of it, and surely must be at front of mind for investors thinking about a roaring twenties basket along with travel and hospitality stocks. And they have some wonderful initiatives in the pipeline which no doubt will see them continue to maintain their position as darlings of the mainstream ESG investing conversation.

Individual investors will draw their own moral lines in the sand. To some, refusing to trade in China because of its animal cruelty rules may seem idealistic. They could make a claim that the recent moderating of rules around testing may be evidence of the benefits of maintaining a cosmopolitan presence in territories. I don’t know how far you can take that argument, because…how can you know, really?

Personally, I’m looking for increasingly aligned alpha (thanks to @davealevine for that beautiful phrase). I want to make investing decisions which push the world towards finding ways of living on this planet which treat the biosphere - the only thin layer of unbelievably lush life wrapped around a floating rock anywhere in the Universe - less as something we have dominion over, and more as a source of health and different kinds wealth.

I want the natural world to be largely untroubled by human intervention, preserved and admired not exploited for profit. And for that reason, setting aside the fact that i really still couldnt ever conceive of supporting Nestlé, i think im going to give this one a pass.

Further reading

https://thegoodshoppingguide.com/ethical-make-up/

https://www.ethicalconsumer.org/company-profile/loreal